Embarking on the journey of Life Insurance Quotes for Families Planning Ahead, this introductory paragraph aims to pique the readers' interest and provide a glimpse into the importance of securing the financial well-being of your loved ones.

Moving forward, we delve into the nuances of different types of policies, factors to consider when making a choice, and the benefits of early planning in the realm of life insurance.

Life Insurance Importance for Families

Life insurance plays a crucial role in providing financial security for families planning ahead. It offers a safety net that ensures loved ones are protected in the event of unexpected circumstances.Life insurance can provide financial stability for families by replacing lost income, covering outstanding debts, such as mortgages or loans, and funding future expenses like education or retirement savings.

In the unfortunate event of a primary breadwinner's passing, life insurance benefits can help the surviving family members maintain their standard of living.

Significance of Life Insurance for Families

Life insurance ensures that families are financially protected in the event of the unexpected death of a loved one. It provides peace of mind knowing that there is a plan in place to secure the family's financial future.

- Life insurance can help cover funeral expenses, which can be a significant financial burden for families.

- It can replace lost income, ensuring that the family can continue to meet their financial obligations.

- Life insurance benefits can be used to pay off outstanding debts, relieving the family of financial stress.

Having life insurance in place can prevent families from facing financial hardship during already difficult times.

Impact of Not Having Life Insurance on Families

The absence of life insurance can have severe consequences for families in the long run. Without a financial safety net in place, families may struggle to cover expenses and maintain their standard of living after the loss of a loved one.

- Surviving family members may face financial instability and uncertainty without life insurance benefits to rely on.

- Funeral and burial costs can create a significant financial strain on families without life insurance coverage.

- Outstanding debts, such as mortgages or loans, may become unmanageable without the financial support of life insurance benefits.

Types of Life Insurance Policies

Life insurance policies come in various types, each offering different features and benefits for families planning ahead. Two primary types of life insurance policies are term life insurance and whole life insurance.

Term Life Insurance

- Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years.

- It is more affordable compared to whole life insurance, making it an attractive option for young families on a budget.

- Term life insurance is ideal for families looking to cover temporary needs, such as paying off a mortgage or funding children's education.

Whole Life Insurance

- Whole life insurance offers lifelong coverage and includes a cash value component that grows over time.

- It provides financial protection for the family's entire life, making it suitable for long-term planning and estate preservation.

- Whole life insurance can be used as a tool for building wealth and leaving a legacy for future generations.

In scenarios where a family is looking for temporary coverage to meet specific financial obligations for a limited period, term life insurance would be the preferred choice. On the other hand, families seeking comprehensive coverage for lifelong protection and long-term financial planning may find whole life insurance more beneficial.

It's essential for families to consider their financial goals, budget, and long-term needs when choosing between term and whole life insurance policies.

Factors to Consider When Choosing a Policy

When selecting a life insurance policy, families need to consider various factors to ensure they choose the most suitable option for their needs. These factors can significantly impact the effectiveness and relevance of the policy in providing financial protection for the family.

Number of Dependents Influence

The number of dependents a family has is a crucial factor to consider when choosing a life insurance policy. Families with more dependents may require a higher coverage amount to ensure financial stability for all members in case of an unfortunate event.

It is essential to account for the needs of each dependent and the level of financial support they would require in the absence of the primary breadwinner.

- Larger families with multiple dependents may need a policy with a higher death benefit to cover ongoing expenses, education costs, and other financial obligations.

- Single-parent families should also consider a policy that adequately provides for their children's needs and future financial security.

Duration and Coverage Amount Importance

When planning ahead with life insurance, families should carefully consider the duration and coverage amount of the policy. These two factors play a significant role in determining how well the policy will serve its intended purpose and provide financial protection to the beneficiaries.

- Duration: Families should choose a policy duration that aligns with their long-term financial goals and the expected needs of their dependents. Short-term policies may not offer adequate coverage, while overly long policies can lead to unnecessary costs.

- Coverage Amount: The coverage amount should be sufficient to replace the lost income of the insured, pay off debts, cover funeral expenses, and provide for the family's future financial needs. Families should assess their current financial situation and future obligations to determine the appropriate coverage amount.

Benefits of Starting Early

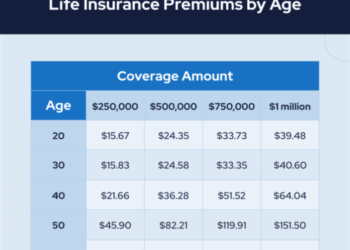

Starting a life insurance policy early can provide numerous advantages for families. By planning ahead and securing a policy sooner rather than later, families can enjoy lower premiums and greater financial security. Additionally, starting early allows families to take advantage of compound interest, which can significantly benefit their long-term financial goals.

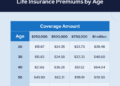

Lower Premiums

- Beginning a life insurance policy at a young age typically results in lower premiums. This is because younger individuals are generally healthier and pose a lower risk to insurance companies.

- As individuals age, the risk of developing health issues increases, leading to higher premiums. By starting early, families can lock in lower rates and save money over the life of the policy.

Compound Interest Benefits

- When families start a life insurance policy early, they have the advantage of time on their side. This allows their policy to accumulate cash value over the years through compound interest.

- Compound interest refers to the interest that is calculated not only on the initial amount invested but also on the accumulated interest from previous periods. This can result in significant growth of the policy's cash value over time.

- By starting early, families can maximize the benefits of compound interest and build a substantial financial cushion for the future, providing added security and peace of mind.

Ultimate Conclusion

Wrapping up our discussion on Life Insurance Quotes for Families Planning Ahead, we emphasize the critical role of securing your family's future through informed decision-making and proactive financial planning.

Questions Often Asked

What factors should families consider when choosing a life insurance policy?

Factors such as the number of dependents, coverage amount, and duration of the policy are crucial considerations for families planning ahead.

How can starting a life insurance policy early benefit families?

Early planning can lead to lower premiums, and the power of compound interest can significantly benefit families when they start planning early.

What are the implications of not having life insurance for families in the long run?

Not having life insurance can leave families financially vulnerable in the event of unforeseen circumstances, jeopardizing their long-term financial security.