Delving into How to Get an Auto Insurance Quote That Fits Your Budget, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

Exploring the intricacies of securing an auto insurance quote that aligns with your financial framework, this guide aims to provide valuable insights and practical tips to navigate the process effectively.

Understanding Auto Insurance Quotes

When it comes to auto insurance, understanding the quotes you receive is crucial in making an informed decision. Auto insurance quotes are influenced by several factors, including:

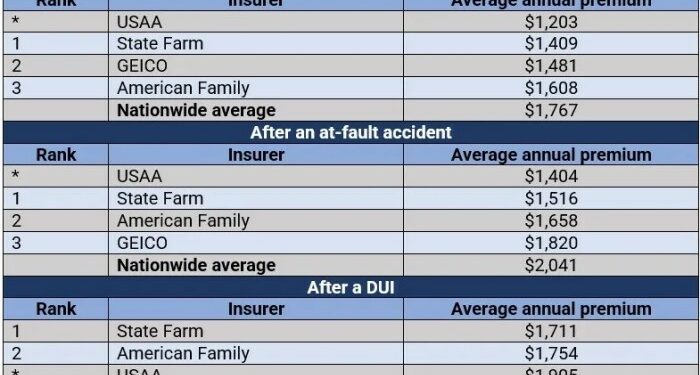

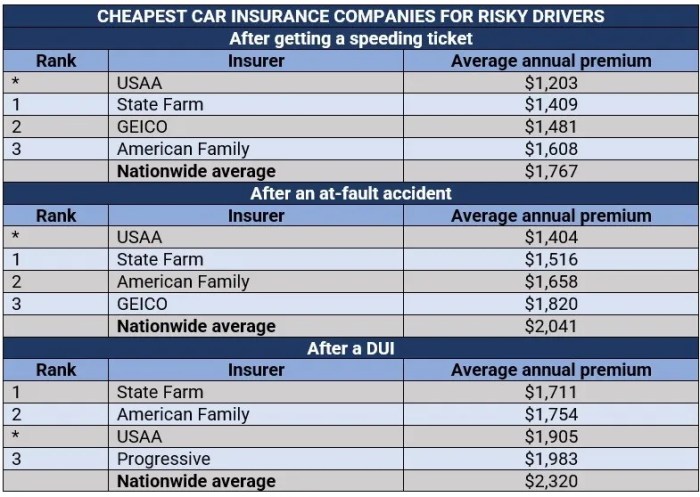

- Your driving record: A clean driving record typically results in lower premiums, while accidents and traffic violations can increase the cost of insurance.

- The type of coverage you choose: Different types of coverage options are available in auto insurance, each affecting the overall cost of your policy.

- The make and model of your vehicle: The value, age, and safety features of your car can impact the insurance premium.

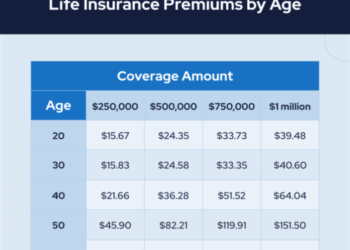

- Your age and location: Younger drivers and those living in areas with high crime rates may face higher insurance rates.

Types of Coverage Options

Auto insurance policies offer various coverage options to suit different needs. Some common types of coverage include:

- Liability coverage: This covers bodily injury and property damage that you may cause to others in an accident.

- Collision coverage: This pays for repairs to your own vehicle in case of a collision with another vehicle or object.

- Comprehensive coverage: This protects your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This covers your expenses if you're in an accident with a driver who has insufficient or no insurance.

Customizing Your Policy to Fit Your Budget

It's essential to customize your auto insurance policy to fit your budget to ensure you're adequately covered without overspending. To do this, consider:

- Evaluating your needs: Assess the level of coverage you need based on your driving habits, vehicle, and financial situation.

- Comparing quotes: Get quotes from multiple insurance providers to find the best rate that meets your coverage needs.

- Adjusting deductibles: Increasing your deductible can lower your premium, but make sure you can afford the out-of-pocket costs in case of a claim.

- Taking advantage of discounts: Inquire about discounts for good driving records, multiple policies, or safety features on your vehicle.

Obtaining Auto Insurance Quotes

When it comes to getting auto insurance quotes, there are a few steps you can follow to ensure you find the best coverage for your budget.

Requesting Auto Insurance Quotes

Here are the steps to request auto insurance quotes from different providers:

- Research: Start by researching various insurance companies to identify reputable providers.

- Provide Information: Be prepared to provide details about your vehicle, driving history, and coverage needs when requesting a quote.

- Online Tools: Many insurance companies offer online tools that allow you to quickly get a quote by entering relevant information.

- Speak to an Agent: If you prefer a more personalized approach, you can contact insurance agents directly to discuss your needs and receive a quote.

Comparing Quotes for the Best Coverage

Here are some tips on comparing quotes to find the best coverage that fits your budget:

- Consider Coverage Options: Look at the different coverage options offered by each provider to determine which one best suits your needs.

- Compare Prices: Compare the prices of the quotes you receive, but remember that the cheapest option may not always provide the best coverage.

- Check Discounts: Inquire about any discounts that may be available to you, such as safe driver discounts or multi-policy discounts.

- Read Reviews: Take the time to read reviews and ratings of insurance companies to get an idea of their customer service and claims process.

Reviewing Quote Details Carefully

It's essential to review the details of each quote carefully to ensure you understand the coverage being offered:

- Deductibles: Pay attention to the deductibles listed in the quote, as this will impact how much you pay out of pocket in the event of a claim.

- Coverage Limits: Make sure you understand the coverage limits Artikeld in the quote to avoid any surprises later on.

- Exclusions: Take note of any exclusions or limitations mentioned in the quote, so you know what is not covered by the policy.

Factors Affecting Auto Insurance Quotes

When it comes to obtaining auto insurance quotes, various factors come into play that can significantly impact the cost of your policy. Understanding these factors is essential in finding an insurance plan that fits your budget and meets your needs.

Personal Information Impact

Personal information such as age, driving history, and location play a crucial role in determining auto insurance quotes. Younger drivers or individuals with a history of accidents may face higher premiums due to the perceived higher risk they pose to insurance companies.

Additionally, living in an area prone to theft or accidents can also lead to increased insurance costs.

Vehicle Type, Mileage, and Usage

The type of vehicle you drive, its mileage, and how you use it can all influence your auto insurance quotes. Generally, more expensive or high-performance vehicles will result in higher premiums. Moreover, if you have a long commute or use your car for business purposes, you may also face increased insurance costs.

Deductibles and Coverage Limits

Choosing the right deductibles and coverage limits can impact the affordability of your auto insurance quotes. Opting for a higher deductible can lower your premiums but may require you to pay more out of pocket in the event of a claim.

On the other hand, selecting lower coverage limits may reduce your premiums but leave you exposed to greater financial risk if an accident occurs.

Tips for Saving on Auto Insurance

When it comes to auto insurance, saving money is always a top priority for most drivers. Fortunately, there are several strategies you can implement to lower your auto insurance premiums without sacrificing coverage. By taking advantage of bundling options, discounts offered by insurance companies, and maintaining a good driving record, you can qualify for lower insurance rates.

Bundling Options and Discounts

One effective way to save on auto insurance is by bundling your policies. Many insurance companies offer discounts to customers who purchase multiple policies from them, such as combining auto and home insurance. By bundling your policies, you can enjoy significant savings on your premiums.

Additionally, be sure to inquire about any other discounts that may be available to you, such as discounts for good students, safe drivers, or for completing a defensive driving course.

Maintaining a Good Driving Record

One of the most impactful ways to save on auto insurance is by maintaining a good driving record. Insurance companies often reward safe drivers with lower premiums, as they are considered lower risk. By avoiding accidents and traffic violations, you can demonstrate to insurance companies that you are a responsible driver, which can result in lower insurance rates.

Remember to drive safely, follow traffic laws, and practice defensive driving techniques to keep your record clean and your premiums low.

Summary

In conclusion, obtaining an auto insurance quote that meets your budgetary requirements involves a careful consideration of various factors and a meticulous comparison of options. By customizing your policy and exploring cost-saving strategies, you can ensure adequate coverage without straining your finances.

FAQ Insights

What factors can influence auto insurance quotes?

Auto insurance quotes can be impacted by factors such as age, driving history, location, type of vehicle, mileage, coverage limits, and deductibles.

How can I request auto insurance quotes from different providers?

You can obtain auto insurance quotes by contacting insurance companies directly, visiting their websites, or using online comparison tools to gather multiple quotes for comparison.

What are some tips for saving on auto insurance premiums?

To save on auto insurance, consider bundling your policies, maintaining a good driving record, and exploring discounts offered by insurance companies.