Navigating the realm of homeowners insurance as a first-time buyer can be overwhelming. This guide aims to shed light on the intricacies of insurance quotes, providing valuable insights to help you make informed decisions.

Exploring the nuances of coverage options, influential factors, and common pitfalls, this guide equips you with the knowledge needed to secure the right insurance for your new home.

Understanding Homeowners Insurance

Homeowners insurance is a crucial financial safety net that provides protection for your home and belongings in case of unforeseen events, such as natural disasters, theft, or accidents.

Types of Coverage

- Property Coverage: This includes coverage for the physical structure of your home and other structures on your property, such as a garage or shed.

- Liability Coverage: Protects you in case someone is injured on your property and you are found legally responsible.

- Personal Property Coverage: Covers the belongings inside your home, such as furniture, clothing, and electronics, in case of theft or damage.

- Additional Living Expenses: Provides coverage for temporary living expenses if your home becomes uninhabitable due to a covered event.

Importance for First-Time Buyers

For first-time buyers, homeowners insurance is especially important as it safeguards your investment in your new home. In the event of a disaster or theft, having insurance can help you rebuild and replace your belongings without facing significant financial strain.

Additionally, many mortgage lenders require homeowners insurance as part of the loan agreement to protect their investment in your property.

Factors Affecting Homeowners Insurance Quotes

When it comes to determining homeowners insurance quotes, several key factors come into play. Factors such as location, home value, deductible, and even credit score can significantly impact the cost of your insurance premiums.

Location

The location of your home plays a crucial role in determining your homeowners insurance quotes. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods may have higher premiums due to the increased risk of damage.

Additionally, homes in high-crime areas may also see higher insurance rates.

Home Value

The value of your home is another important factor that influences insurance quotes. Generally, the higher the value of your home, the more expensive it will be to insure. This is because higher-value homes may cost more to repair or replace in the event of damage or loss.

Deductible

The deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in lower insurance premiums, while a lower deductible means higher premiums. It's essential to choose a deductible that you can comfortably afford in the event of a claim.

Credit Score

Your credit score can also impact the cost of your homeowners insurance. Insurers often use credit scores as a factor in determining premiums, as studies have shown a correlation between credit history and insurance claims. Maintaining a good credit score can help lower your insurance costs, while a poor credit score may lead to higher premiums.

Obtaining Homeowners Insurance Quotes

As a first-time buyer, obtaining homeowners insurance quotes can seem like a daunting task. However, with the right guidance and understanding, you can navigate through this process smoothly. Here are some tips to help you get started and make informed decisions:

Comparing Quotes from Different Insurance Companies

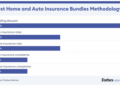

When requesting homeowners insurance quotes, it's essential to compare offers from multiple insurance companies to ensure you are getting the best coverage at a competitive price. Here are some tips on how to compare quotes effectively:

- Request quotes from at least three different insurance companies to compare rates and coverage options.

- Consider the deductible amount and how it impacts the premium cost.

- Review the coverage limits and exclusions to understand what is included in the policy.

- Look for any discounts or bundling options that can help lower the overall cost.

- Check the financial stability and customer service reputation of the insurance company before making a decision.

Understanding Policy Limits and Coverage Details

Policy limits and coverage details play a crucial role in determining the level of protection you will receive from your homeowners insurance policy. Here's why it's important to pay attention to these aspects when requesting quotes:

Policy limits determine the maximum amount an insurance company will pay for a covered loss, so it's crucial to ensure your limits are adequate to protect your assets.

- Review the coverage types included in the policy, such as dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

- Understand any exclusions or limitations in the policy that may affect your coverage in specific situations.

- Consider additional endorsements or riders that can provide extra protection for high-value items or specific risks not covered in a standard policy.

- Ask questions and seek clarification from the insurance company or agent about any terms or conditions you don't understand.

Common Mistakes to Avoid

When it comes to getting homeowners insurance quotes, first-time buyers often make some common mistakes that can have significant consequences. It's essential to be aware of these pitfalls to ensure you get the right coverage for your home. Here are some tips on how to avoid underinsuring or overinsuring your home and why it's crucial to review and update your insurance coverage regularly.

Underestimating Replacement Costs

One of the most common mistakes first-time buyers make is underestimating the replacement cost of their home. It's essential to ensure that your coverage reflects the current value of your property. Failing to do so could leave you financially vulnerable in the event of a disaster.

Choosing a Low Deductible

Opting for a low deductible may seem like a good idea to save money on premiums, but it can end up costing you more in the long run. A higher deductible can lower your premiums and prevent you from filing small claims that could lead to increased rates.

Ignoring Additional Coverage Options

First-time buyers often overlook additional coverage options that could provide valuable protection for their home. It's essential to consider factors like flood insurance, earthquake insurance, or personal property coverage to ensure you are adequately protected.

Neglecting to Update Coverage

Many homeowners forget to update their insurance coverage as their circumstances change. Whether you've made renovations, acquired valuable items, or experienced changes in your home's value, it's crucial to review and update your coverage regularly to avoid being underinsured.

Final Review

In conclusion, understanding the dynamics of homeowners insurance quotes is crucial for first-time buyers. By staying informed and vigilant, you can ensure that your investment is adequately protected, giving you peace of mind as you embark on this new chapter of homeownership.

Top FAQs

What factors determine homeowners insurance quotes?

Factors such as location, home value, deductible, and credit score can all impact the cost of homeowners insurance.

How can first-time buyers compare insurance quotes effectively?

First-time buyers should gather quotes from multiple companies, ensuring they understand policy limits and coverage details for accurate comparisons.

What are common mistakes to avoid when getting homeowners insurance quotes?

Avoid underinsuring or overinsuring your home by carefully reviewing and updating your insurance coverage regularly.