Delve into the realm of affordable full coverage car insurance without hidden fees with this informative guide. Learn how to secure the protection you need without breaking the bank.

Explore the various factors that impact insurance rates and uncover tips for finding the best deal on full coverage policies.

Factors affecting car insurance rates

When it comes to determining the cost of car insurance, several factors come into play. These factors can vary from person to person and can significantly impact the premiums you pay for coverage. Understanding these factors is crucial in obtaining the best possible rate for your car insurance.

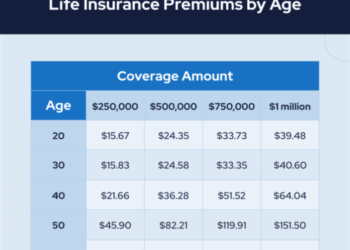

Age

Age is a key factor that insurance companies consider when calculating car insurance rates. Younger drivers, especially those under the age of 25, typically face higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

Driving History

Your driving history, including past accidents, traffic violations, and claims history, also plays a significant role in determining your insurance rates. Drivers with a clean record are often rewarded with lower premiums, while those with a history of accidents or violations may face higher costs.

Location

Where you live can impact your car insurance rates as well. Urban areas with higher rates of accidents and theft may result in higher premiums compared to rural areas with lower risk factors. Additionally, factors like weather conditions and traffic congestion in your area can also influence insurance costs.

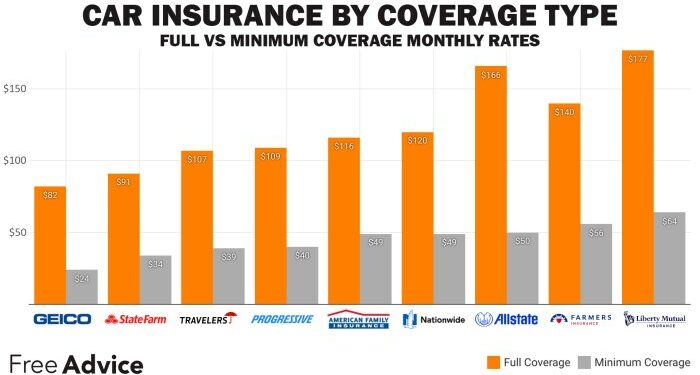

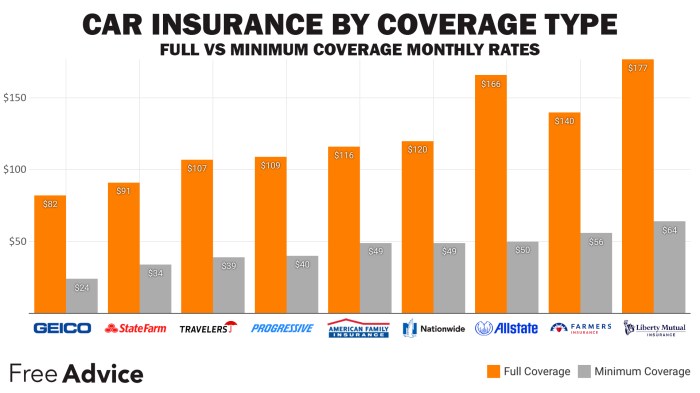

Coverage Types

The type and amount of coverage you choose for your car insurance policy can also affect the rates you pay. Basic liability coverage is typically less expensive than comprehensive coverage, which offers more extensive protection. Adding optional coverages like collision or uninsured motorist coverage can increase your premiums.Examples of how different factors can lead to variations in insurance costs:

- A 21-year-old driver with a history of accidents living in a high-crime urban area will likely pay more for car insurance than a 40-year-old driver with a clean record living in a rural area.

- Choosing a higher coverage limit or adding additional coverages like roadside assistance can increase your insurance premiums compared to opting for basic liability coverage only.

Understanding full coverage car insurance

Full coverage car insurance is a type of auto insurance policy that provides a higher level of protection compared to basic liability coverage. It typically includes both liability insurance and coverage for damage to your own vehicle, offering a more comprehensive level of financial protection.

What full coverage car insurance includes

- Liability coverage for bodily injury and property damage to others

- Collision coverage for damage to your own vehicle in an accident

- Comprehensive coverage for non-collision incidents like theft, vandalism, or natural disasters

- Uninsured/underinsured motorist coverage for accidents involving drivers with insufficient insurance

Comparing and contrasting full coverage with other types of car insurance

Unlike basic liability insurance that only covers damage to others, full coverage provides protection for your own vehicle as well. While it may come with a higher premium, it offers a wider range of coverage options and financial security in case of accidents or unforeseen events.

Benefits of having full coverage

- Peace of mind knowing your vehicle is protected in various situations

- Financial security against costly repairs or replacements

- Ability to customize coverage options based on your needs

Scenarios where full coverage insurance proves valuable

- Getting into a major accident that results in significant damage to your vehicle

- Experiencing a break-in or theft of your car

- Encountering a natural disaster like a hurricane or flood that damages your vehicle

Hidden fees in car insurance

When it comes to car insurance, hidden fees can catch policyholders off guard and add unexpected costs to their coverage. It is essential to understand common hidden fees, how to spot them in insurance policies, the importance of reading the fine print, and tips to avoid falling victim to these extra charges.

Common Hidden Fees in Car Insurance

- Administrative fees: Some insurance companies may charge administrative fees for policy processing or changes.

- Convenience fees: Additional charges may apply for using certain payment methods or installment plans.

- Processing fees: Fees related to policy renewal, cancellation, or reinstatement can sometimes be hidden in the fine print.

Spotting Hidden Fees in Insurance Policies

- Read the fine print: Thoroughly review your policy documents to uncover any hidden fees or charges.

- Ask questions: Don't hesitate to ask your insurance provider about any unclear or suspicious fees listed in your policy.

- Compare quotes: Get quotes from multiple insurers to compare not only premiums but also fees and charges included in the policies.

Importance of Reading the Fine Print

- Understanding the terms: Reading the fine print helps you understand the specific details of your coverage, including any hidden fees.

- Avoiding surprises: Being aware of all potential charges upfront can prevent unexpected costs later on.

Tips to Avoid Falling Victim to Hidden Fees

- Ask for a breakdown: Request a detailed breakdown of all fees and charges included in your policy before making a decision.

- Review your policy annually: Regularly reviewing your policy can help you stay informed about any changes in fees or charges.

- Seek transparency: Choose insurance providers known for transparent pricing and clear communication about fees.

Finding cheap full coverage car insurance

When it comes to finding affordable full coverage car insurance, there are several strategies you can consider to lower your insurance costs and secure the best deal for your needs.

Bundling Policies

One effective way to reduce the cost of full coverage car insurance is by bundling your policies. This involves combining multiple insurance policies, such as car insurance and homeowners insurance, with the same provider. By bundling, insurance companies often offer discounts, ultimately saving you money on your overall insurance costs.

Maintaining a Good Credit Score

Your credit score can also impact the cost of your full coverage car insurance. Insurance providers may use your credit score as a factor in determining your premium rates. By maintaining a good credit score, you can potentially qualify for lower insurance rates, making full coverage more affordable.

Comparing Quotes

It's crucial to shop around and compare quotes from different insurance providers when looking for cheap full coverage car insurance. By obtaining quotes from various companies, you can identify the best deal that offers comprehensive coverage at a competitive price.

Be sure to consider the coverage limits, deductibles, and any additional benefits included in the quotes.

Discounts and Programs

Many insurance providers offer discounts and programs that can help reduce the overall cost of full coverage insurance. These discounts may be based on factors such as safe driving habits, low mileage, or being a member of certain organizations. Additionally, some companies offer usage-based insurance programs that adjust rates based on your driving behavior, potentially saving you money on your premiums.

Ending Remarks

In conclusion, navigating the world of car insurance doesn't have to be daunting. By understanding the key aspects of full coverage without hidden fees, you can make informed decisions to safeguard your vehicle and your wallet.

FAQ Corner

What are some common hidden fees in car insurance?

Common hidden fees include processing fees, administrative fees, and cancellation fees.

How can I find affordable full coverage car insurance?

You can explore options such as bundling policies, maintaining a good credit score, and comparing quotes from different providers.

Why is full coverage car insurance beneficial?

Full coverage provides extensive protection for your vehicle and offers peace of mind in various situations.