Business Insurance for LLC Startups in Competitive Markets sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As new businesses navigate the competitive landscape, the need for comprehensive insurance coverage becomes paramount. Understanding the nuances of insurance in a cutthroat market can be the key to long-term success and stability.

Overview of Business Insurance for LLC Startups in Competitive Markets

Business insurance for LLC startups in competitive markets refers to the various insurance policies that provide coverage and protection to limited liability companies (LLCs) operating in highly competitive business environments. It is essential for LLC startups to have adequate insurance coverage to safeguard their assets, mitigate risks, and ensure financial stability in the face of potential challenges.

Importance of Having Insurance Coverage in a Competitive Business Environment

Having insurance coverage in a competitive business environment is crucial for LLC startups to protect their business interests and assets. It provides financial protection against unforeseen events such as lawsuits, property damage, or business interruptions. Without adequate insurance, LLC startups risk facing significant financial losses that could potentially threaten their viability in the market.

Specific Challenges and Risks Faced by LLC Startups in Competitive Markets

LLC startups in competitive markets face a myriad of challenges and risks that can impact their operations and financial well-being. Some of the specific risks include:

- Intense competition from established businesses

- Market volatility and economic uncertainties

- Legal liabilities and lawsuits

- Cybersecurity threats and data breaches

- Supply chain disruptions

Types of Insurance Coverage Needed

Starting a business as an LLC in a competitive market requires careful consideration of insurance coverage to protect your assets and mitigate risks. Here are the essential types of insurance coverage required for LLC startups:

General Liability Insurance

General liability insurance provides coverage for claims of bodily injury, property damage, and advertising injury. It is essential for protecting your business from lawsuits and claims that may arise from third parties.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, provides coverage for claims of negligence or inadequate work. This type of insurance is crucial for service-based businesses to protect against claims of professional mistakes or oversights.

Property Insurance

Property insurance covers physical assets such as buildings, equipment, inventory, and furniture from risks such as fire, theft, vandalism, or natural disasters. It is vital to safeguard your business property and ensure continuity of operations.Having adequate coverage for each type of insurance is significant for LLC startups to mitigate financial risks and protect the business from unforeseen circumstances.

By carrying the right insurance policies, you can focus on growing your business without worrying about potential liabilities.

Factors to Consider When Choosing Insurance Policies

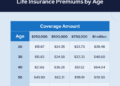

When selecting insurance policies for their LLC startups, entrepreneurs need to carefully consider various factors to ensure adequate coverage and protection. Factors such as the nature of the business, industry trends, and market competition can significantly influence the insurance choices made.

Nature of the Business

Understanding the unique risks and liabilities associated with the specific industry in which the startup operates is crucial. For example, a technology startup may require cyber liability insurance to protect against data breaches, while a construction company may need coverage for property damage and bodily injury.

Industry Trends and Market Competition

Keeping abreast of industry trends and competitive landscape can help LLC startups identify emerging risks that may require specialized insurance coverage. For instance, a retail startup operating in a highly competitive market may need product liability insurance to protect against claims of defective products.

Market Conditions Impacting Insurance Requirements

Market conditions, such as the prevalence of lawsuits or regulatory changes, can impact the insurance requirements of LLC startups. In a litigious market, professional liability insurance may be essential to protect against claims of negligence or errors in professional services.

Cost Management Strategies for Insurance

Effective cost management strategies are crucial for LLC startups operating in competitive markets. By implementing the following tips, businesses can better manage their insurance expenses and optimize their financial resources.

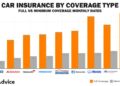

Comparing Insurance Quotes

- Obtain quotes from multiple insurance providers to compare coverage options and prices.

- Consider both premium costs and coverage limits to ensure adequate protection for your business.

- Review any additional benefits or discounts offered by insurers to maximize cost savings.

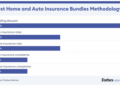

Bundling Policies for Savings

- Bundle different insurance policies, such as general liability and property insurance, with the same provider for potential discounts.

- Consolidating policies can streamline administrative tasks and simplify the insurance management process.

- Ask insurers about package deals or customized options tailored to your business needs for cost-effective solutions.

Negotiating with Insurers

- Engage in negotiation with insurance companies to secure better rates or additional coverage benefits.

- Highlight your business's risk management strategies and safety measures to demonstrate lower risk to insurers.

- Be prepared to leverage competitive quotes and market insights to negotiate favorable terms with insurers.

Risk Assessment and Mitigation

- Conduct a thorough risk assessment to identify potential hazards and areas of vulnerability within your business operations.

- Implement risk mitigation measures to reduce the likelihood of insurance claims and minimize financial exposure.

- By proactively managing risks, businesses can lower insurance premiums and demonstrate responsibility to insurers.

Understanding Legal Requirements and Compliance

Legal requirements play a crucial role in shaping the insurance landscape for LLC startups in competitive markets. Compliance with state laws and regulations is essential for ensuring adequate protection and risk management. Non-compliance can have serious consequences, highlighting the importance of maintaining proper documentation to meet legal standards.

State Laws and Regulations Impact

State laws and regulations dictate the minimum insurance requirements for businesses, including LLC startups. These requirements vary depending on the location and nature of the business. It is essential for startups to familiarize themselves with the specific legal obligations in their state to avoid penalties and ensure comprehensive coverage.

- Research and Understand State Laws: Startups must research and understand the insurance requirements mandated by the state where they operate. This includes minimum coverage limits for liability insurance, workers' compensation, and other essential policies.

- Consult Legal Professionals: Seeking guidance from legal professionals specializing in business insurance can help navigate the complex landscape of state laws and regulations. Legal advice can ensure startups are compliant and adequately protected.

- Regular Compliance Audits: Conducting regular compliance audits to review insurance policies and documentation is crucial for maintaining compliance with state laws. This proactive approach can prevent potential legal issues and financial liabilities.

Consequences of Non-Compliance

Non-compliance with state laws and regulations can result in severe consequences for LLC startups. Failure to meet insurance requirements can lead to fines, legal disputes, and even the suspension of business operations. It is essential for startups to prioritize compliance to protect their assets and reputation.

- Financial Penalties: Violating state insurance laws can result in significant financial penalties that can burden startups financially. These penalties can detract from the resources available for business growth and development.

- Lawsuits and Legal Challenges: Non-compliance exposes startups to lawsuits and legal challenges, potentially resulting in costly settlements or court judgments. Maintaining proper insurance coverage is key to mitigating these risks.

- Business Disruption: In extreme cases, non-compliance can lead to the suspension or revocation of business licenses, disrupting operations and damaging the company's credibility. Proper documentation and adherence to legal requirements are essential for long-term sustainability.

Concluding Remarks

In conclusion, Business Insurance for LLC Startups in Competitive Markets is not just a necessity but a strategic asset in the journey of a startup. By safeguarding against potential risks and liabilities, businesses can thrive and grow even in the most competitive environments.

Commonly Asked Questions

What are the key types of insurance coverage needed for LLC startups?

LLC startups typically require general liability, professional liability, and property insurance to protect against various risks.

How can LLC startups effectively manage insurance costs in competitive markets?

LLC startups can manage costs by comparing insurance quotes, bundling policies, and engaging in negotiations with insurers to secure favorable rates.

What legal requirements should LLC startups adhere to regarding insurance in competitive markets?

LLC startups must comply with state laws and regulations related to insurance, ensuring proper documentation and adherence to legal standards.