Embarking on the journey of Business Insurance for LLC Owners: What Coverage Do You Really Need, this opening paragraph aims to captivate and engage the readers, providing a glimpse into the important aspects of this topic.

The subsequent paragraph will delve deeper into the specifics and intricacies of business insurance for LLC owners.

Overview of Business Insurance for LLC Owners

Business insurance is essential for LLC owners to protect their assets and minimize financial risks associated with running a business. It provides coverage for various aspects of the business, including liability, property damage, and employee-related risks.

Types of Business Insurance for LLC Owners

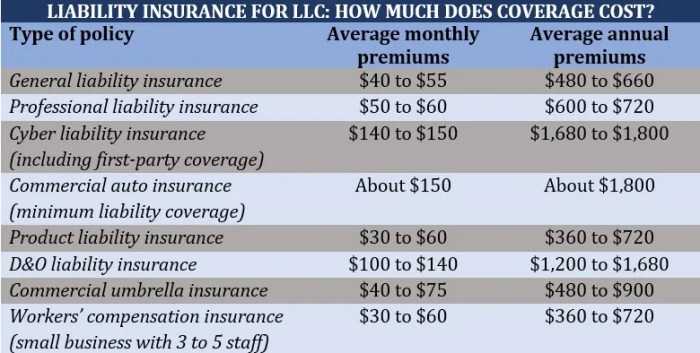

- General Liability Insurance: Covers legal fees and damages in case of lawsuits related to third-party injuries or property damage.

- Property Insurance: Protects business property, equipment, and inventory from damage or theft.

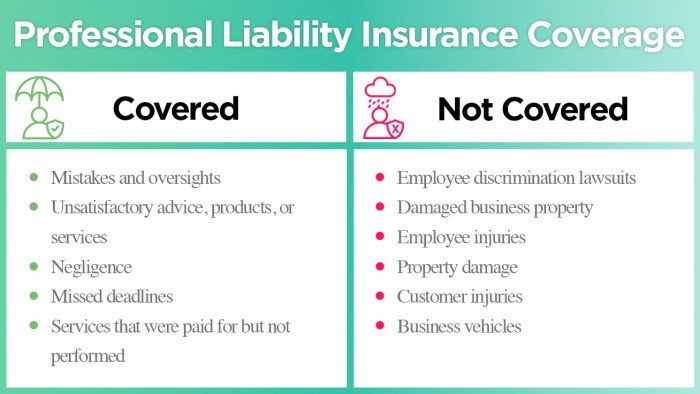

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, it covers claims of negligence or inadequate work.

- Workers' Compensation Insurance: Provides coverage for medical expenses and lost wages for employees injured on the job.

Comparison with Other Types of Insurance

Business insurance for LLC owners differs from personal insurance such as health or auto insurance, as it specifically addresses the unique risks faced by businesses. While personal insurance focuses on individual needs, business insurance protects the assets and operations of the company as a whole.

General Liability Insurance for LLC Owners

General liability insurance is essential for LLC owners as it provides coverage for various scenarios where the business may be held liable for bodily injury, property damage, or advertising injury. This type of insurance protects the LLC and its owners from financial losses resulting from lawsuits or claims filed against the business.

What General Liability Insurance Covers

- Medical expenses for injuries that occur on business premises

- Legal fees and settlement costs for lawsuits related to property damage caused by the business

- Coverage for advertising injuries, such as slander or copyright infringement

Examples of Scenarios Where General Liability Insurance is Beneficial

- If a customer slips and falls in your store, sustaining injuries, general liability insurance can cover their medical expenses

- If a product sold by your LLC causes harm to a customer, resulting in a lawsuit, this insurance can cover legal fees and settlements

- In cases where your business is accused of copyright infringement in its advertising, general liability insurance can provide coverage

Limitations of General Liability Insurance for LLC Owners

- General liability insurance does not cover professional errors or negligence, which would require a separate professional liability policy

- It may not cover intentional acts or contractual disputes

- Coverage limits may vary, and additional policies may be needed for comprehensive protection

Property Insurance for LLC Owners

Property insurance is essential for LLC owners to protect their physical assets, such as buildings, equipment, inventory, and furniture, from perils like fire, theft, vandalism, and natural disasters.

Coverage Provided by Property Insurance

- Property insurance covers the cost of repairing or replacing damaged or stolen assets.

- It may also provide coverage for business interruption, helping cover lost income if your business is temporarily unable to operate due to a covered loss.

- Some policies may include coverage for equipment breakdown or damage to electronic data.

Difference Between Property Insurance and General Liability Insurance

- General liability insurance covers third-party bodily injury, property damage, and advertising injury claims, while property insurance protects your own assets.

- Property insurance is more focused on physical damage to your property, while general liability insurance deals with lawsuits and liability claims.

- Having both types of insurance is crucial to ensure comprehensive coverage for your LLC.

Tips on Determining the Amount of Property Insurance Needed

- Conduct a thorough inventory of your business assets to estimate their value accurately.

- Consider the location of your business and the risk of natural disasters or other perils in the area.

- Consult with an insurance agent to understand the different coverage options available and determine the appropriate coverage limits based on your specific needs.

- Regularly review and update your property insurance policy to reflect any changes in your business operations or asset value.

Workers’ Compensation Insurance for LLC Owners

Workers' compensation insurance is crucial for LLC owners as it provides protection for both the employees and the business in case of work-related injuries or illnesses. This type of insurance helps cover medical expenses, lost wages, and legal fees that may arise from a workplace accident.

Importance of Workers’ Compensation Insurance for LLC Owners

Workers' compensation insurance is mandatory in most states for businesses with employees, including LLCs. It not only helps protect the employees by providing financial support in case of injury but also safeguards the business from potential lawsuits related to workplace accidents.

Requirements for LLC Owners regarding Workers’ Compensation Insurance

- LLC owners are typically required to carry workers' compensation insurance if they have employees, even if they are the only employee.

- Failure to have workers' compensation insurance in place can result in penalties, fines, and even legal action against the LLC owner.

Examples of Situations where Workers’ Compensation Insurance would come into play

- If an employee slips and falls at the workplace, sustaining injuries that require medical treatment and time off work, workers' compensation insurance would cover the medical expenses and lost wages.

- In case of a work-related illness due to exposure to harmful substances in the workplace, workers' compensation insurance would help cover the medical costs and provide compensation for any lost wages during treatment.

Ending Remarks

Concluding our discussion on Business Insurance for LLC Owners: What Coverage Do You Really Need, this final paragraph will summarize the key points and leave readers with a lasting impression.

Frequently Asked Questions

What factors should LLC owners consider when determining the amount of property insurance they need?

LLC owners should take into account the value of their business property, location, potential risks, and any specific requirements from lenders or landlords.

Is workers' compensation insurance mandatory for all LLC owners?

Requirements for workers' compensation insurance vary by state, so it's essential to check the specific regulations in your location.