When it comes to understanding Term Life Insurance Quotes and what influences your premium rates, there are key factors that play a significant role in determining the cost of your coverage. From age to lifestyle choices, these elements can impact how much you pay for your policy.

Let's delve into the details to help you navigate the world of term life insurance with confidence.

Factors influencing term life insurance premium rates

When it comes to determining the premium rates for term life insurance, several factors come into play. These factors can significantly impact how much you will pay for coverage. Let's delve into some key aspects that influence term life insurance premium rates.

Age

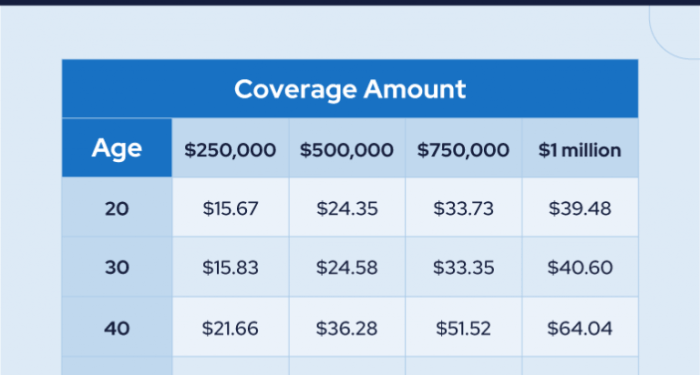

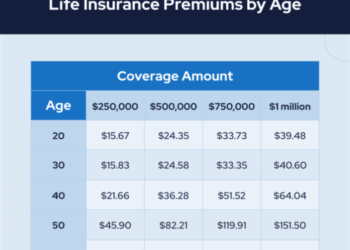

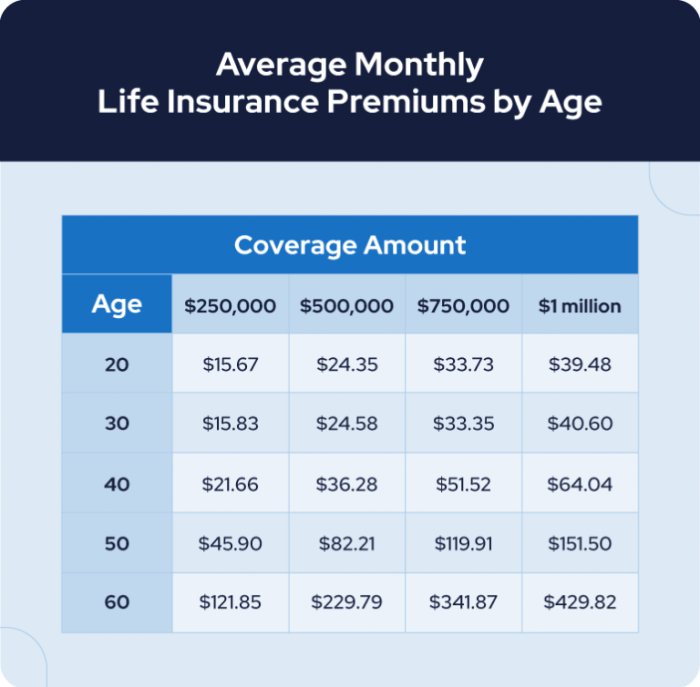

Age is one of the most critical factors that affect term life insurance premium rates. Generally, the younger you are when you purchase a policy, the lower your premium will be. This is because younger individuals are perceived as lower risk and are less likely to pass away during the term of the policy.

Health Conditions

Your health condition plays a crucial role in determining your term life insurance premium rates. Individuals with pre-existing health conditions may face higher premiums due to the increased risk associated with their condition. For example, someone with a history of heart disease or cancer may have to pay more for coverage compared to someone in good health.

Lifestyle Choices

Lifestyle choices such as smoking, excessive drinking, or engaging in high-risk activities can also impact your term life insurance premium rates. Insurers consider these factors when assessing your risk level and setting your premium. For instance, smokers are typically charged higher premiums than non-smokers due to the health risks associated with smoking.

Coverage Amount and Term Length

The coverage amount you choose and the length of the term can also influence your premium rates. Generally, the higher the coverage amount, the higher the premium. Similarly, longer-term lengths may result in higher premiums compared to shorter terms. It's essential to strike a balance between the coverage you need and what you can afford to pay in premiums.

Understanding underwriting in term life insurance

When it comes to term life insurance, underwriting plays a crucial role in determining the premium rates that policyholders will pay. Underwriting is the process by which insurance companies evaluate the risk associated with insuring an individual and set the appropriate premium based on that risk.

Role of underwriting in determining premium rates

Underwriting helps insurance companies assess the likelihood of a policyholder making a claim during the term of the policy. By considering factors such as age, health, lifestyle, occupation, and medical history, underwriters can determine the level of risk a policyholder presents and set the premium rates accordingly.

Information typically requested during underwriting

During the underwriting process, insurance companies typically request information such as medical records, lifestyle habits, family medical history, and sometimes even a medical exam. This information helps underwriters accurately assess the risk profile of the individual and determine the appropriate premium rates.

Impact of medical exams on premium rates

Medical exams can have a significant impact on premium rates as they provide detailed information about an individual's health status. Based on the results of the medical exam, underwriters may adjust the premium rates to reflect any health risks identified during the examination.

Effect of underwriting on the overall cost of term life insurance

Underwriting directly affects the overall cost of term life insurance. If an individual is deemed to be a higher risk based on the underwriting evaluation, they may end up paying higher premium rates. On the other hand, individuals with lower risk profiles may benefit from more affordable premium rates due to the favorable underwriting assessment.

Comparison of premium rates among different insurance companies

When it comes to term life insurance, premium rates can vary significantly among different insurance companies. Understanding the key factors that lead to these variations can help you make an informed decision when choosing a policy.

Factors influencing premium rate variations

- Underwriting criteria: Each insurance company has its own underwriting criteria, which can result in differences in how they assess risk and determine premium rates.

- Claims experience: Insurance companies factor in their claims experience when setting premium rates. Companies with higher claim payouts may charge higher premiums to compensate for the increased risk.

- Operating expenses: The operating expenses of an insurance company can impact premium rates. Companies with higher overhead costs may charge higher premiums to cover these expenses.

Coverage options and add-ons impact

- Level of coverage: The amount of coverage you choose will directly impact your premium rates. Higher coverage amounts typically result in higher premiums.

- Add-on options: Adding riders or additional coverage options to your policy can increase your premium rates. These add-ons provide extra benefits but come at an additional cost.

Discounts and tips for comparison

- Multi-policy discounts: Some insurance companies offer discounts if you purchase multiple policies from them, such as combining term life insurance with auto or home insurance.

- Healthy lifestyle discounts: Maintaining a healthy lifestyle, such as not smoking or regular exercise, can sometimes lead to lower premium rates.

- Compare quotes: To effectively compare premium rates from different insurance providers, be sure to request quotes for the same coverage amount and term length. This will allow you to make a true apples-to-apples comparison.

Strategies to reduce term life insurance premium rates

When it comes to term life insurance, there are several strategies you can implement to reduce your premium rates and make the policy more affordable. By understanding these strategies, you can make informed decisions about your coverage and potentially save money in the long run.

Policy Riders and Their Impact on Premium Rates

Policy riders are additional features or benefits that you can add to your term life insurance policy for an extra cost. While these riders can enhance your coverage, they can also impact your premium rates. Common riders include accelerated death benefit riders, accidental death benefit riders, and waiver of premium riders.

Before adding any riders to your policy, carefully consider whether the benefits outweigh the additional cost.

Purchasing Term Life Insurance at a Younger Age

One of the most effective ways to reduce term life insurance premium rates is to purchase a policy at a younger age. Younger individuals are generally considered lower risk by insurance companies, leading to lower premium rates. By locking in a policy when you are young and healthy, you can secure more affordable rates for the duration of your coverage.

Maintaining a Healthy Lifestyle

Insurance companies often take into account your overall health and lifestyle habits when determining your premium rates. By maintaining a healthy lifestyle, such as exercising regularly, eating a balanced diet, and avoiding tobacco products, you can potentially reduce your premium rates.

Some insurance companies even offer discounts for policyholders who demonstrate healthy behaviors.

Cost-Saving Measures for Term Life Insurance Policies

There are several cost-saving measures you can take when purchasing a term life insurance policy. These include comparing quotes from multiple insurance companies to find the most competitive rates, opting for a shorter term length or lower coverage amount, paying your premiums annually instead of monthly to avoid processing fees, and avoiding unnecessary riders that may increase your premium rates without providing significant benefits.

Epilogue

As we wrap up our discussion on Term Life Insurance Quotes and the factors that affect your premium rates, it's clear that various aspects like age, health conditions, and coverage options all play a crucial role in determining the cost of your policy.

By understanding these factors, you can make informed decisions when choosing the right coverage for your needs.

Common Queries

How does age impact term life insurance premium rates?

Age is a key factor in determining premium rates for term life insurance. Generally, the younger you are when you purchase a policy, the lower your premium rates are likely to be. This is because younger individuals are considered lower risk by insurance companies.

What role does underwriting play in determining premium rates?

Underwriting involves assessing an individual's risk profile to determine their premium rates. Factors like health, lifestyle, and medical history are considered during underwriting, influencing the cost of your term life insurance policy.

How can policy riders impact premium rates?

Policy riders are additional features or benefits that can be added to a term life insurance policy. Depending on the rider chosen, it can increase or decrease your premium rates. For example, adding a critical illness rider may lead to higher premiums.

Are there discounts available to lower premium rates?

Insurance companies may offer discounts to policyholders to lower premium rates. These discounts could be for factors like being a non-smoker, bundling policies, or maintaining good health habits. It's worth exploring these options to reduce your insurance costs.