Embarking on the journey of understanding Commercial Auto Insurance Basics for Small and Medium Businesses, this guide aims to provide valuable insights and essential information on this crucial topic.

Exploring the nuances of commercial auto insurance, this guide will shed light on various aspects that businesses need to consider to protect their assets and finances effectively.

Importance of Commercial Auto Insurance for Small and Medium Businesses

Commercial auto insurance is a vital aspect for small and medium businesses that rely on vehicles for their operations. It provides protection against unforeseen events that could potentially lead to financial losses and legal liabilities.

Risks of Not Having Commercial Auto Insurance

Not having commercial auto insurance can expose businesses to various risks, such as:

- Financial burden: In the event of an accident, the business may be responsible for covering repair costs, medical expenses, and legal fees out of pocket.

- Lawsuits: Without insurance, the business could face lawsuits from injured parties seeking compensation, leading to significant legal costs.

- Loss of assets: A serious accident involving a company vehicle could result in the loss of valuable assets if the business is unable to cover the associated costs.

Protection of Assets and Finances

Commercial auto insurance serves as a safety net for businesses by:

- Providing coverage for vehicle damage: Insurance can help cover repair or replacement costs for company vehicles involved in accidents or other incidents.

- Offering liability protection: Insurance can protect the business from financial losses due to legal claims and lawsuits resulting from accidents caused by company vehicles.

- Ensuring business continuity: With insurance coverage, businesses can avoid disruptions to their operations and maintain financial stability in the face of unexpected events.

Essential Scenarios for Commercial Auto Insurance Coverage

There are numerous scenarios where commercial auto insurance coverage has proven to be essential, such as:

- Accidents resulting in property damage or bodily injury to third parties.

- Theft or vandalism of company vehicles.

- Employees using company vehicles for business purposes getting into accidents.

Types of Coverage Offered

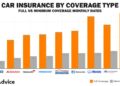

Commercial auto insurance offers various types of coverage to protect small and medium businesses from financial losses in case of accidents or damages involving their vehicles. Let's dive into the different coverage options available and their significance.

Liability Coverage

Liability coverage is a fundamental component of commercial auto insurance, as it helps cover the costs associated with injuries or property damage to others in an accident where the insured party is at fault. This coverage is crucial for businesses to protect their assets and finances in case of lawsuits or legal claims.

Collision Coverage

Collision coverage is designed to help pay for repairs or replacement of the insured vehicle in case of a collision with another vehicle or object, regardless of who is at fault. This coverage is essential for businesses that rely on their vehicles for daily operations to minimize downtime and maintain their fleet.

Comprehensive Coverage

Comprehensive coverage provides protection for the insured vehicle against non-collision incidents, such as theft, vandalism, natural disasters, or falling objects. This coverage is valuable for businesses looking to safeguard their vehicles from a wide range of risks beyond just accidents on the road.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is crucial for businesses as it helps cover the costs if the insured vehicle is involved in an accident with a driver who does not have insurance or enough insurance to fully compensate for the damages. This coverage ensures that businesses are not left financially vulnerable in such situations.

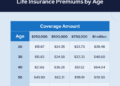

Factors Affecting Premium Costs

When it comes to commercial auto insurance, several key factors can influence the cost of premiums for small and medium businesses. Understanding these factors is crucial for businesses to make informed decisions and potentially lower their insurance costs.

Type of Business

The nature of your business plays a significant role in determining the cost of commercial auto insurance. Industries with higher risk levels, such as construction or delivery services, may face higher premiums due to the increased likelihood of accidents or claims.

Number of Vehicles

The number of vehicles your business owns and operates will also impact your insurance premiums. Generally, the more vehicles you have, the higher the cost of insurance. Insuring a larger fleet can increase the risk of accidents and claims, leading to higher premiums.

Driving Records

The driving records of your employees who operate company vehicles are crucial factors in determining insurance costs. Businesses with employees who have clean driving records are likely to enjoy lower premiums compared to those with a history of accidents or traffic violations.

Coverage Limits

The coverage limits you choose for your commercial auto insurance policy will directly affect the cost of premiums

Tips to Lower Insurance Costs

- Implement driver safety training programs to reduce the risk of accidents.

- Maintain a fleet of well-maintained vehicles to minimize the likelihood of breakdowns or accidents.

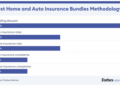

- Consider bundling commercial auto insurance with other policies for potential discounts.

- Review and update your insurance policy regularly to ensure you have the right coverage at the best price.

Choosing the Right Policy

When it comes to selecting a commercial auto insurance policy for small and medium businesses, it is crucial to take the necessary steps to ensure adequate coverage. Assessing coverage needs based on the nature of business operations is key to finding the right policy that offers protection in case of accidents or other unforeseen events.

Additionally, determining the appropriate coverage limits and deductibles is essential to strike a balance between protection and affordability.

Assessing Coverage Needs

- Consider the type of vehicles used in business operations and the frequency of use.

- Evaluate the driving records of employees who will be operating the vehicles.

- Assess the potential risks involved in the business activities that require vehicle use.

Determining Coverage Limits and Deductibles

- Look at the value of the business assets that need protection in case of an accident.

- Consider the potential costs of medical expenses and liability claims in the event of an accident.

- Balance the coverage limits with the deductibles to find a policy that offers adequate protection without breaking the bank.

Claims Process and Coverage Limitations

When it comes to commercial auto insurance, understanding the claims process and coverage limitations is crucial for small and medium businesses. Knowing what to expect and being aware of any exclusions can help businesses navigate through potential challenges in the event of an accident or damage.

Typical Claims Process

- When a covered incident occurs, the business should immediately notify their insurance provider and provide details of the incident.

- An insurance adjuster will investigate the claim, assess the damage, and determine the coverage amount based on the policy.

- The business may need to provide additional documentation or evidence to support the claim, such as police reports or repair estimates.

- Once the claim is approved, the insurance company will provide the necessary funds to cover the damages or losses, up to the policy's coverage limits.

Coverage Limitations and Exclusions

- Some common coverage limitations in commercial auto insurance policies include restrictions on the type of vehicles covered, such as trucks or trailers.

- Exclusions may apply to specific uses of the vehicle, such as racing or off-road activities.

- Coverage limitations may also come into play for certain types of damage, such as wear and tear, mechanical breakdowns, or intentional acts.

Examples of Coverage Limitations

- If a business vehicle is used for deliveries and is involved in an accident while making a personal trip, the claim may be denied due to coverage limitations.

- In cases where the driver is under the influence of alcohol or drugs at the time of the accident, coverage may be limited or excluded.

- If the vehicle is overloaded beyond its capacity and causes damage, the insurance company may not cover the claim due to policy restrictions.

Last Word

In conclusion, Commercial Auto Insurance Basics for Small and Medium Businesses is a critical component for safeguarding your company's vehicles and resources. By choosing the right policy and understanding the coverage options, businesses can navigate the complexities of insurance with confidence.

Question & Answer Hub

What are the risks of not having commercial auto insurance?

Not having commercial auto insurance can expose businesses to financial liabilities in case of accidents, damage, or theft involving company vehicles.

How can businesses lower their commercial auto insurance costs?

Businesses can potentially lower their insurance costs by improving driving records, opting for higher deductibles, and exploring discounts offered by insurers.