Starting with Homeowners Insurance Quote Tips for High-Value Properties, this paragraph aims to engage readers with valuable insights on the topic.

Providing information on the importance of homeowners insurance for high-value properties, factors to consider when getting insurance quotes, tips for lowering premiums, and coverage options.

Importance of Homeowners Insurance for High-Value Properties

Homeowners insurance is essential for high-value properties to protect against unforeseen circumstances that could result in significant financial loss. Without adequate insurance coverage, homeowners of high-value properties are at risk of bearing the full cost of damages or losses on their own.

Potential Risks Covered by Homeowners Insurance

- Property Damage: Homeowners insurance can provide coverage for damages caused by natural disasters like hurricanes, earthquakes, or fires.

- Theft or Vandalism: In the event of a break-in or vandalism, homeowners insurance can help cover the cost of stolen or damaged property.

- Liability Claims: If someone is injured on your property, homeowners insurance can help cover medical expenses and legal fees if you are found liable.

Financial Implications of Inadequate Insurance Coverage

Not having sufficient homeowners insurance for high-value properties can lead to devastating financial consequences. For example, if a fire destroys a portion of your home and you don't have adequate coverage, you may have to pay out of pocket for repairs or even rebuild your property entirely.

This can result in a significant financial burden that could have been avoided with the right insurance policy in place.

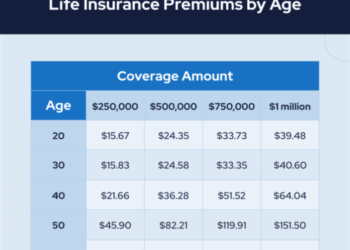

Factors to Consider When Getting a Homeowners Insurance Quote

When seeking homeowners insurance quotes for high-value properties, several key factors come into play. Insurance companies take various elements into consideration to determine the cost of insuring a high-value property.

Impact of Property Location

The location of a property is a critical factor that insurance companies consider when providing quotes for high-value properties. Properties located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may have higher insurance premiums due to the increased risk of damage.

- Properties in high-crime areas may also face higher insurance costs due to the risk of theft or vandalism.

- On the other hand, properties in safe neighborhoods with low crime rates and good access to emergency services may qualify for lower insurance premiums.

Significance of Property Features

The features of a high-value property can significantly impact insurance costs. Insurance companies often look at the property's security systems, such as alarm systems, surveillance cameras, or security personnel, to assess the risk of burglary or intrusion.

- Properties constructed with high-quality materials that are more resistant to damage from natural disasters or accidents may qualify for lower insurance premiums.

- Additionally, the presence of fire safety measures such as sprinkler systems or fire-resistant roofing materials can also impact insurance quotes.

Tips for Lowering Homeowners Insurance Premiums for High-Value Properties

When it comes to insuring high-value properties, homeowners are always looking for ways to reduce insurance premiums without sacrificing coverage. Here are some strategies to help lower insurance costs for high-value properties:

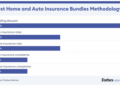

Benefits of Bundling Insurance Policies

- Bundling your homeowners insurance with other insurance policies, such as auto or umbrella insurance, can often lead to discounts on your premiums.

- Insurance companies appreciate having multiple policies with the same customer, which can result in savings for the homeowner.

Home Improvements and Renovations

- Updating your home's security features, such as installing a security system or adding smoke detectors, can make your property less risky to insure and potentially lead to lower premiums.

- Renovating your home to make it more disaster-resistant, like reinforcing the roof or upgrading plumbing and electrical systems, can also result in premium discounts.

Understanding Coverage Options for High-Value Properties

When it comes to high-value properties, understanding the coverage options available is crucial to ensure comprehensive protection for your assets.

Types of Coverage Options

- Replacement Cost Coverage: This type of coverage ensures that your property will be repaired or replaced at the actual cost without accounting for depreciation. It provides full coverage for the value of your property.

- Actual Cash Value Coverage: This coverage takes depreciation into account when determining the reimbursement for your property. While it may result in lower payouts, it typically comes with lower premiums.

Importance of Liability Coverage

Liability coverage is essential for high-value properties as it protects you in the event of lawsuits resulting from injuries or property damage that occur on your premises. It can cover legal fees, medical expenses, and settlement costs, providing you with financial security when faced with a liability claim.

Additional Coverage Options

In addition to standard coverage options, high-value properties may require additional insurance for valuable assets like jewelry or art. These items may exceed the limits of your standard policy, making it important to consider specialized coverage to adequately protect your valuable possessions.

Ultimate Conclusion

In conclusion, Homeowners Insurance Quote Tips for High-Value Properties offer essential guidance to protect your valuable assets effectively.

FAQ Guide

What are the key factors insurance companies consider when providing quotes for high-value properties?

Insurance companies consider factors like property location, features, and risks when determining quotes for high-value properties.

How can I reduce insurance premiums for my high-value property?

You can lower premiums by bundling policies, making home improvements, and seeking discounts without compromising coverage.

Do high-value properties require additional coverage options?

Yes, high-value properties may need additional coverage for items like jewelry or art to ensure comprehensive protection.