Delving into the realm of How Home and Auto Insurance Simplifies Policy Management, we uncover the seamless integration of these two essential coverages. Brace yourself for a journey through the intricacies of policy management, where convenience and efficiency reign supreme.

Exploring the benefits of bundling, streamlined tools, and the impact on premiums and coverage, this discussion promises to shed light on the complexities of insurance management in a simplified manner.

Introduction to Home and Auto Insurance

Home and auto insurance are essential types of coverage that protect individuals from financial loss in the event of damage to their home or vehicle. Home insurance provides coverage for the physical structure of a home, personal belongings, and liability protection in case someone is injured on the property.

Auto insurance, on the other hand, provides coverage for vehicles in case of accidents, theft, or damage.

Importance of Having Both Types of Insurance

Having both home and auto insurance is crucial to ensure comprehensive protection for your assets and financial well-being. By having these policies in place, you can rest assured that you are covered in various situations that may arise, such as natural disasters, accidents, or theft.

Common Challenges in Managing Home and Auto Insurance Separately

- Tracking Multiple Policies: Managing separate policies for home and auto insurance can be overwhelming and confusing, especially when it comes to keeping track of renewal dates, coverage details, and premium payments.

- Duplicate Coverage: Without proper coordination, individuals may end up with duplicate coverage or coverage gaps, leading to inefficiencies and potential financial losses.

- Lack of Consolidation: Keeping track of multiple insurance providers and policies can be time-consuming and inefficient, requiring individuals to juggle different contact points, paperwork, and renewal processes.

Benefits of Bundling Home and Auto Insurance

When it comes to managing insurance policies, bundling home and auto insurance can offer several advantages. Not only does it simplify the process, but it can also lead to cost savings. Let's explore the benefits of bundling these two essential policies.

Advantages of Bundling Home and Auto Insurance Policies

- Convenience: By bundling home and auto insurance, you only have to deal with one insurance provider for both policies. This streamlines communication, making it easier to manage your coverage.

- Discounts: Insurance companies often offer discounts when you bundle multiple policies with them. This can result in significant savings on your premiums.

- Single Deductible: Some insurers offer a single deductible for both home and auto claims when policies are bundled. This means you only have to pay one deductible in the event of a claim, potentially saving you money.

- Customized Coverage: Bundling allows you to customize your coverage to suit your needs. You can tailor your policy to include specific protections for your home and vehicles.

How Bundling Simplifies Policy Management

- One Point of Contact: With bundled policies, you have a single point of contact for any questions, changes, or claims. This makes it more convenient to manage your insurance needs.

- Consistent Renewals: Bundling ensures that your home and auto insurance renew at the same time. This eliminates the hassle of keeping track of multiple renewal dates.

- Combined Billing: Bundling often means you receive a single bill for both policies. This simplifies the payment process and helps you stay organized.

Cost Comparison: Separate Policies vs. Bundled Policies

| Separate Policies | Bundled Policies | |

|---|---|---|

| Premium Costs | Higher premiums for individual policies | Potential savings with bundled policies |

| Deductibles | Separate deductibles for home and auto | Possible single deductible for both |

| Convenience | Dealing with multiple insurers | One insurance provider for both policies |

Consolidated Policy Management Tools

When it comes to managing both home and auto insurance policies seamlessly, there are various tools and technologies available to help policyholders stay organized and informed.

Online Account Portals

- Many insurance companies offer online account portals where customers can view and manage all their policies in one place.

- These portals allow users to make payments, update information, file claims, and access important documents anytime, anywhere.

Mobile Apps

- Some insurance providers have mobile apps that enable policyholders to manage their home and auto insurance policies on the go.

- Through these apps, users can easily view policy details, track claims, contact customer service, and receive important notifications.

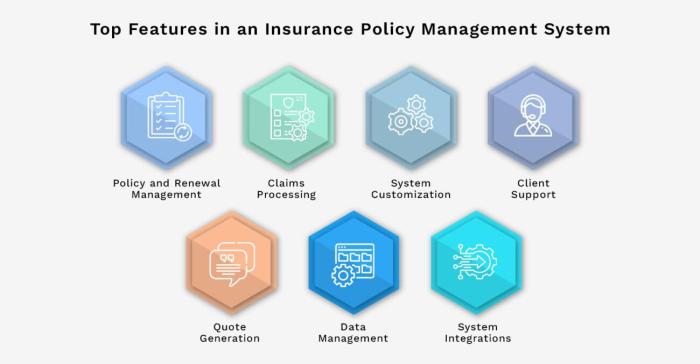

Integrated Policy Management Systems

- There are integrated policy management systems that combine both home and auto insurance policies into one comprehensive platform.

- These systems offer a centralized dashboard where users can monitor coverage, deductibles, premiums, and policy renewal dates in real-time.

Companies such as State Farm, Allstate, and Progressive are known for providing robust policy management tools that simplify the process for policyholders and enhance their overall insurance experience.

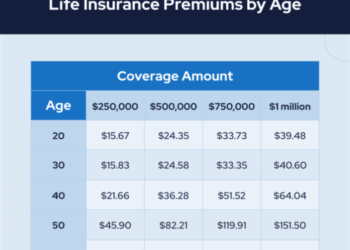

Impact on Premiums and Coverage

When bundling home and auto insurance policies, there are significant impacts on both premiums and coverage. Bundling can often lead to cost savings and streamlined policy management, but it's essential to understand how this affects your insurance needs.

Premiums and Coverage Overview

- Bundling home and auto insurance policies typically results in a discount on premiums from the insurance provider. This discount can vary depending on the insurance company and the specific policies being bundled.

- By combining policies, insurance companies can reduce administrative costs, leading to lower premiums for customers who choose to bundle.

- While bundling can help save money on premiums, it's crucial to ensure that the coverage provided meets your specific needs for both home and auto insurance.

Differences in Coverage Options

- When policies are bundled, insurance companies may offer different coverage options compared to standalone policies. This could include unique discounts, coverage limits, and additional perks for bundled policies.

- It's important to review the coverage details of a bundled policy to understand any differences in coverage options compared to individual home or auto insurance policies.

Maximizing Savings and Coverage Benefits

- Before bundling your home and auto insurance, compare quotes from different insurance providers to ensure you're getting the best deal on premiums and coverage.

- Consider adjusting coverage limits and deductibles to find a balance between cost savings and sufficient coverage for your home and auto insurance needs.

- Review your insurance needs annually to make sure your bundled policy still provides adequate coverage and savings based on any changes in your circumstances.

Closing Summary

As we wrap up our exploration into How Home and Auto Insurance Simplifies Policy Management, it becomes evident that consolidating these policies offers not just convenience but also potential savings and enhanced coverage. Embrace the simplicity and efficiency of managing your insurance needs in one cohesive package.

FAQ Summary

How can bundling home and auto insurance policies benefit me the most?

Bundling can often lead to discounts, simplified management, and potentially enhanced coverage options, offering comprehensive protection under one umbrella.

Are there specific tools available to help manage home and auto insurance policies together?

Yes, many insurance companies provide online portals or mobile apps that allow policyholders to conveniently view and manage both their home and auto insurance policies in one place.

What factors should I consider when comparing costs between separate policies and bundled policies?

When comparing costs, it's essential to factor in not just the premium amounts but also any potential discounts, coverage limits, and the overall convenience of managing both policies together.