Cheap Auto Insurance Myths That Can Cost You More sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Delve into the world of auto insurance myths that could potentially lead you astray, uncovering the truths behind popular misconceptions and shedding light on the importance of making informed decisions.

Common Myths About Cheap Auto Insurance

When it comes to cheap auto insurance, there are several myths that can mislead consumers and potentially cost them more in the long run. It's important to debunk these myths to make informed decisions and ensure you get the best coverage for your needs.

Myth 1: Cheap Auto Insurance Means Less Coverage

One common myth is that opting for cheap auto insurance means sacrificing coverage. While it's true that some cheaper policies may offer less coverage, there are also affordable options that provide adequate protection. It's essential to compare different policies and understand the coverage options to find the best fit for your needs.

Myth 2: Cheap Insurance Is Always the Best Deal

Another misconception is that the cheapest insurance policy is always the best deal. However, these policies may come with higher deductibles or limited coverage, which could end up costing you more in the event of an accident. It's crucial to consider the overall value and coverage provided by a policy, not just the price.

Myth 3: Cheap Insurance Companies Are Unreliable

Some people believe that cheaper insurance companies are unreliable and may not pay out claims promptly. While it's essential to research the reputation of an insurance company before purchasing a policy, price alone does not determine reliability. Many affordable insurance companies provide excellent customer service and efficient claims processing.

Myth 4: Cheap Auto Insurance Is Only for Bad Drivers

There is a misconception that cheap auto insurance is only for bad drivers with a history of accidents or traffic violations. In reality, many factors determine the cost of insurance, including the type of vehicle, driving record, and location. It's possible to find affordable insurance rates even with a clean driving record.

Myth 5: Cheap Insurance Policies Lack Customer Support

Some consumers believe that cheaper insurance policies lack adequate customer support or assistance when filing a claim. While this may be true for some companies, many affordable insurers offer excellent customer service and support. It's essential to research the customer reviews and ratings of an insurance company before making a decision.

Factors Influencing Auto Insurance Costs

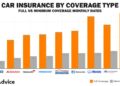

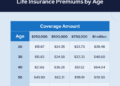

Understanding the factors that influence auto insurance premiums is crucial in making informed decisions when choosing the right coverage. Let's explore how these factors differ between cheap and comprehensive insurance options and how this knowledge can help you save money while getting adequate coverage.

Driving Record

Your driving record plays a significant role in determining your auto insurance premium. A clean record with no accidents or traffic violations will generally result in lower premiums. However, if you have a history of accidents or tickets, you can expect to pay more for insurance.

This factor remains consistent whether you choose cheap or comprehensive coverage.

Vehicle Type and Age

The type of vehicle you drive and its age also impact your insurance costs. Newer, more expensive cars typically cost more to insure due to higher repair or replacement costs. On the other hand, older vehicles with a lower value may result in cheaper premiums.

When opting for cheap insurance, you may have to settle for less coverage for your car's damages compared to comprehensive insurance, which offers better protection.

Coverage Limits and Deductibles

The coverage limits and deductibles you choose can directly affect your insurance premiums. Opting for higher coverage limits and lower deductibles will lead to higher premiums, while choosing lower coverage limits and higher deductibles can lower your premiums. It's essential to strike a balance between adequate coverage and affordability.

Comprehensive insurance typically offers higher coverage limits and lower deductibles compared to cheap insurance.

Location

Where you live can impact your auto insurance costs. Urban areas with higher traffic congestion and crime rates may result in higher premiums compared to rural areas. Additionally, some regions have more severe weather conditions that can lead to an increased risk of accidents or damages.

Understanding how your location influences your insurance costs can help you make informed decisions when selecting coverage options.

Credit Score

Your credit score can also play a role in determining your auto insurance premiums. Insurers often use credit information to predict the likelihood of a policyholder filing a claim. Maintaining a good credit score can result in lower insurance premiums, while a poor credit score may lead to higher rates.

This factor remains consistent across both cheap and comprehensive insurance options.

Risks of Opting for Cheap Auto Insurance

When it comes to selecting auto insurance, opting for the cheapest policy available might seem like a cost-effective choice. However, it's crucial to understand the risks associated with choosing inadequate coverage solely based on price. In this section, we will delve into the potential consequences of opting for cheap auto insurance and why finding a balance between cost and coverage is essential.

Inadequate Coverage Leads to Financial Loss

- Choosing a cheap auto insurance policy with minimal coverage limits can leave you vulnerable to significant financial losses in the event of an accident. Insufficient coverage may not cover all damages, leaving you responsible for paying out-of-pocket expenses.

- Real-life Scenario: John opted for the cheapest auto insurance policy he could find to save money. Unfortunately, when he was involved in a major collision, his policy did not provide adequate coverage for the damages to his vehicle and medical expenses.

John had to pay thousands of dollars out of pocket, causing a substantial financial burden.

Lack of Comprehensive Protection

- Low-cost auto insurance policies often come with limited coverage options, excluding essential protections such as comprehensive and collision coverage. Without these safeguards, you may not be fully protected against various risks, including theft, vandalism, or damage from natural disasters.

- Real-life Scenario: Sarah purchased a cheap auto insurance policy without comprehensive coverage. When her car was stolen, she realized too late that her policy did not cover theft-related incidents. Sarah had to bear the entire cost of replacing her vehicle, highlighting the importance of comprehensive protection.

Legal Consequences of Insufficient Coverage

- Driving with inadequate auto insurance coverage can lead to legal repercussions, including fines, license suspension, or even legal action. State laws mandate minimum insurance requirements, and failing to meet these standards can result in severe penalties.

- Real-life Scenario: Mike thought he could get away with purchasing the cheapest auto insurance policy that did not meet the state's minimum coverage requirements. During a routine traffic stop, law enforcement discovered his lack of proper insurance, leading to hefty fines and a suspension of his driver's license.

Tips for Finding Affordable Auto Insurance

Finding affordable auto insurance is essential to ensure you have the coverage you need without breaking the bank. Here are some strategies to help you find the right policy at a price that fits your budget.

Shop Around and Compare Quotes

When looking for affordable auto insurance, it's crucial to shop around and compare quotes from different insurers. Prices can vary significantly between companies, so taking the time to get multiple quotes can help you find the best deal.

- Get quotes from at least three different insurance companies to compare rates.

- Consider using online comparison tools to streamline the process and get quotes quickly.

- Don't forget to look beyond the big-name insurers and consider smaller, regional companies that may offer competitive rates.

Take Advantage of Discounts and Bundling Options

Many insurance companies offer discounts that can help lower your premiums. By taking advantage of these discounts and bundling your policies, you can save even more money on your auto insurance.

- Ask about discounts for safe driving records, good student grades, or completing a defensive driving course.

- Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, to qualify for a multi-policy discount.

- Explore options for paying your premium in full upfront or setting up automatic payments to potentially save on fees.

Consider Adjusting Your Coverage and Deductibles

Another way to find affordable auto insurance is by adjusting your coverage levels and deductibles. While it's important to have adequate coverage, you may be able to lower your premiums by making strategic changes to your policy.

- Review your coverage limits and consider raising or lowering them based on your needs and budget.

- Increase your deductibles to reduce your premium, but make sure you can afford the out-of-pocket costs in case of a claim.

- Eliminate unnecessary add-ons or extras that may be driving up the cost of your insurance.

Outcome Summary

In conclusion, Cheap Auto Insurance Myths That Can Cost You More unravels the complexities of insurance misconceptions, guiding you towards a path of clarity and understanding. By debunking these myths, you are empowered to navigate the realm of auto insurance with confidence and wisdom.

FAQ Section

What are some common myths about cheap auto insurance?

Some common myths include the belief that cheaper insurance means lesser coverage or that all insurance companies offer the same rates.

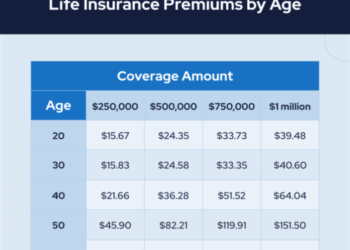

What factors influence auto insurance costs?

Factors like age, driving record, and type of vehicle can impact insurance premiums. Comprehensive insurance usually costs more due to higher coverage levels.

What are the risks of opting for cheap auto insurance?

Opting for the cheapest insurance can lead to inadequate coverage, leaving you vulnerable in case of accidents or emergencies. Balancing cost and coverage is crucial.

How can I find affordable auto insurance without compromising coverage?

Strategies include shopping around for quotes, exploring discounts, and bundling options. Comparing different insurers can help in finding the best deal.