Exploring the nuances between Term Life Insurance Quotes and Permanent Coverage opens up a world of possibilities when it comes to securing your future. From understanding the basics to delving into the complexities, this discussion promises to shed light on the most crucial aspects of both options.

As we navigate through the intricacies of insurance coverage, we aim to provide you with valuable insights that will empower you to make informed decisions about your financial well-being.

Understanding Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. In the event of the policyholder's death during the term, the beneficiaries receive a death benefit payout.

Different Term Lengths

Term life insurance policies offer a range of term lengths that policyholders can choose from based on their needs. Common term lengths include:

- 10-year term

- 20-year term

- 30-year term

Key Features and Benefits

Term life insurance has several key features and benefits that make it a popular choice:

- Affordability: Term life insurance is typically more affordable than permanent life insurance, making it a cost-effective option for many individuals.

- Flexibility: Policyholders can choose the term length that aligns with their financial goals and obligations, providing flexibility in coverage.

- Simple and straightforward: Term life insurance policies are easy to understand, with clear terms and conditions Artikeld for policyholders.

- Income replacement: Term life insurance can help replace lost income for beneficiaries in the event of the policyholder's death, providing financial security.

Permanent Coverage Explained

![Term vs Permanent Life Insurance: Which Should You Choose? [Infographic] Term vs Permanent Life Insurance: Which Should You Choose? [Infographic]](https://protection.goodstats.id/wp-content/uploads/2025/12/7aa242_6853a6bb4a3c4111b988510ac75a4836mv2.jpg)

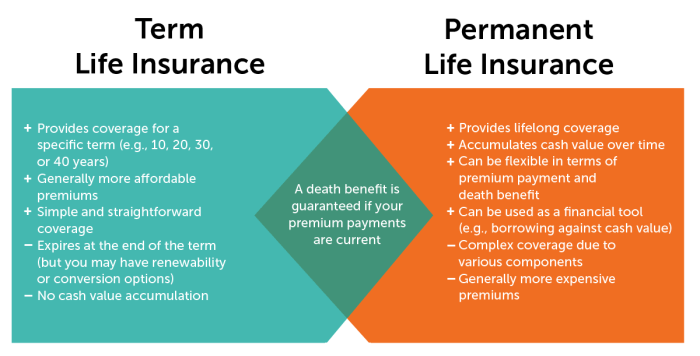

Permanent life insurance is a type of life insurance that provides coverage for the entire lifetime of the insured individual, as long as premiums are paid. Unlike term life insurance which covers a specific period, permanent coverage does not expire and includes a cash value component that grows over time.

Comparison between Permanent and Term Life Insurance

- Permanent life insurance offers coverage for a lifetime, while term life insurance covers a specific term, such as 10, 20, or 30 years.

- Permanent policies have a cash value component that accumulates over time, providing a source of savings, whereas term policies do not have a cash value.

- Premiums for permanent coverage are typically higher than term insurance due to the lifetime coverage and cash value component.

Types of Permanent Life Insurance

There are different types of permanent life insurance, with the two main categories being whole life and universal life insurance.

Whole Life Insurance

Whole life insurance provides coverage for the entire life of the insured individual and includes a guaranteed death benefit and cash value that grows at a fixed rate. Premiums remain level throughout the policy's lifetime, providing predictability for the policyholder.

Universal Life Insurance

Universal life insurance offers more flexibility than whole life insurance, allowing policyholders to adjust their premiums and death benefits. The cash value component of universal life policies grows based on the performance of underlying investments, offering the potential for higher returns but also greater risk.

Factors to Consider When Choosing Between Term and Permanent Coverage

When deciding between term and permanent life insurance, there are several crucial factors individuals should take into consideration. These factors play a significant role in determining which type of coverage aligns best with their financial goals and family needs.

Financial Goals and Family Needs

- Financial Goals: Consider your long-term financial objectives, such as saving for retirement or leaving an inheritance for your loved ones. Permanent coverage offers a cash value component that can accumulate over time and provide additional benefits.

- Family Needs: Evaluate the financial needs of your dependents, such as children or a spouse. Term life insurance may be more suitable if you have temporary financial obligations, like paying off a mortgage or funding your children's education.

Scenarios for Term Life Insurance and Permanent Coverage

- Term Life Insurance: Opt for term coverage if you need temporary protection for a specific period, like until your children are financially independent or until you pay off your debts. It is often more affordable and straightforward.

- Permanent Coverage: Choose permanent life insurance if you seek lifelong protection and want to build cash value over time. This type of coverage can offer financial security for your beneficiaries and potentially serve as a financial asset later in life.

Obtaining Insurance Quotes

When it comes to obtaining insurance quotes for term life coverage, the process is relatively straightforward. You can start by reaching out to insurance companies, either online or through an agent, and providing some basic information about yourself. This typically includes your age, gender, health history, and the amount of coverage you are looking for.

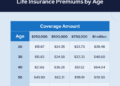

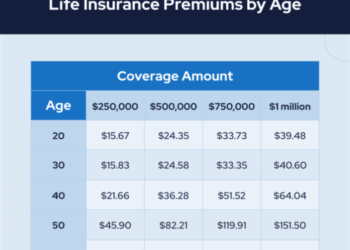

Factors Impacting the Cost of Term Life Insurance Premiums

Several factors can impact the cost of term life insurance premiums. These include:

- Your age at the time of application

- Your overall health and any pre-existing medical conditions

- The term length of the policy you choose

- The coverage amount you select

Comparison with Permanent Coverage

Obtaining quotes for term life insurance is typically quicker and more straightforward compared to permanent coverage. Permanent coverage, such as whole life insurance, involves a more complex underwriting process due to the lifetime coverage and cash value component.

Conclusion

In conclusion, the choice between Term Life Insurance Quotes and Permanent Coverage ultimately boils down to your individual needs and long-term objectives. By weighing the benefits and drawbacks of each option, you can pave the way for a secure and stable future for you and your loved ones.

Common Queries

What factors should I consider when choosing between term and permanent life insurance?

When deciding between the two, it's essential to assess your financial goals, family needs, and long-term objectives. Term life insurance may be more suitable for short-term needs, while permanent coverage offers lifelong protection.

How do I obtain insurance quotes for term life insurance?

You can obtain term life insurance quotes by reaching out to insurance providers, either online or through agents. They will assess your needs and provide you with quotes based on factors like age, health, and coverage amount.

What are the key differences between whole life and universal life insurance?

Whole life insurance provides coverage for your entire life and includes a cash value component, while universal life insurance offers more flexibility in premium payments and death benefits.