Embark on a journey into the realm of life insurance quotes explained for long-term financial security, where we unravel the intricacies of this vital aspect with a fresh perspective.

Delve deeper into the nuances of life insurance quotes and their pivotal role in safeguarding your financial future.

Understanding Life Insurance

Life insurance is a financial product that provides a lump-sum payment to designated beneficiaries upon the death of the insured individual. The primary purpose of life insurance is to provide financial protection and security for loved ones in the event of the policyholder's passing.

Types of Life Insurance Policies

- Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years. It is typically more affordable and straightforward compared to other types of life insurance.

- Whole Life Insurance: Offers coverage for the entire lifetime of the insured individual. It includes a savings component known as cash value, which grows over time.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest over time. It offers flexibility in terms of premium payments and death benefits.

- Variable Life Insurance: Allows policyholders to allocate their premiums among various investment options, such as stocks and bonds. The cash value and death benefit can fluctuate based on the performance of these investments.

Importance of Life Insurance for Financial Security

Life insurance plays a crucial role in ensuring that your loved ones are financially protected in case of your untimely death. It can help cover expenses such as funeral costs, mortgage payments, debts, and future financial needs. Having life insurance provides peace of mind and a sense of security knowing that your family will be taken care of financially.

Life Insurance Quotes

Life insurance quotes are estimates provided by insurance companies that detail the cost of a specific life insurance policy based on various factors. These quotes help individuals understand how much they would need to pay to secure financial protection for their loved ones in case of their untimely death.

Factors Influencing Life Insurance Quotes

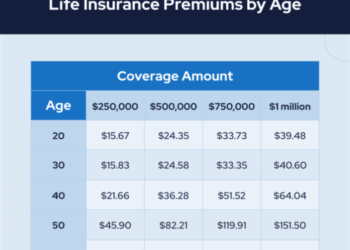

- Your age: Younger individuals typically receive lower life insurance quotes compared to older individuals due to lower risk of mortality.

- Health condition: Your overall health and medical history play a significant role in determining life insurance quotes. Those with pre-existing medical conditions may receive higher quotes.

- Smoking habits: Smokers are considered higher risk by insurance companies, leading to higher life insurance quotes compared to non-smokers.

- Policy coverage amount: The higher the coverage amount you choose, the higher your life insurance quote will be.

- Term length: The length of the policy term also impacts the life insurance quote, with longer terms generally resulting in higher quotes.

Comparison of Quotes from Different Insurance Providers

- It's essential to compare life insurance quotes from different providers to ensure you are getting the best coverage at the most competitive rate.

- Quotes can vary significantly between insurance companies due to their underwriting criteria, policy offerings, and pricing strategies.

- By obtaining multiple quotes and comparing them side by side, you can make an informed decision and choose the policy that best fits your needs and budget.

Long-Term Financial Security

Life insurance plays a crucial role in ensuring long-term financial security for individuals and families. By providing a financial safety net in the event of unexpected circumstances, life insurance can offer peace of mind and stability for the future.One significant benefit of life insurance is its ability to provide financial support to loved ones after the policyholder's passing.

This can help cover living expenses, mortgage payments, education costs, and other financial obligations, ensuring that the family's financial well-being is protected in the long run.Choosing the right life insurance policy is essential for maintaining financial stability over time. Different types of life insurance, such as term life, whole life, and universal life, offer varying benefits and coverage options.

By selecting a policy that aligns with specific financial goals and needs, individuals can ensure that their loved ones are adequately protected and financially secure in the long term.

Examples of Long-Term Benefits

- Income Replacement: Life insurance can replace lost income for the family in the event of the policyholder's death, ensuring that financial obligations are met.

- Debt Repayment: Life insurance proceeds can be used to pay off debts, such as a mortgage or outstanding loans, relieving the family of financial burdens.

- Estate Planning: Life insurance can help with estate planning by providing liquidity to cover estate taxes and other expenses, preserving assets for future generations.

Final Review

As we wrap up our exploration of life insurance quotes for long-term financial security, the essence of its significance in ensuring stability and protection becomes crystal clear.

Questions Often Asked

What factors influence life insurance quotes?

Life insurance quotes are influenced by factors such as age, health condition, coverage amount, and the type of policy chosen.

How does choosing the right life insurance policy contribute to financial stability over time?

Selecting the right life insurance policy ensures that your loved ones are financially secure in the long run, providing a safety net for unforeseen circumstances.