Embarking on the journey of comparing auto insurance quotes the smart way opens up a world of possibilities and savings. Understanding the intricacies of insurance quotes, gathering them efficiently, evaluating key details, and ultimately choosing the best one can be a game-changer in securing the right coverage for your vehicle.

Let's delve into the nuances of this process and unlock the secrets to making informed decisions when it comes to auto insurance.

Understanding Auto Insurance Quotes

When comparing auto insurance quotes, it is crucial to understand the various components that make up these quotes. Factors such as coverage types, deductibles, limits, and additional features can greatly influence the cost and level of protection provided by an insurance policy.

Components of an Auto Insurance Quote

- Liability Coverage: This covers costs associated with bodily injury and property damage if you are at fault in an accident.

- Collision Coverage: This pays for repairs to your car after a collision, regardless of fault.

- Comprehensive Coverage: This protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This covers you if you are in an accident with a driver who has insufficient or no insurance.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers regardless of fault.

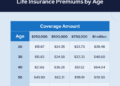

Factors Influencing Insurance Quotes

- Driving Record: A clean driving record typically results in lower premiums.

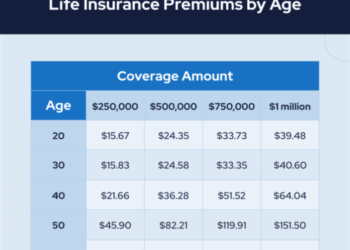

- Age and Gender: Younger drivers and males tend to pay higher premiums due to higher risk.

- Location: Urban areas with higher rates of accidents or theft may result in higher premiums.

- Vehicle Type: The make, model, and age of your vehicle can impact insurance costs.

- Credit Score: In some states, insurance companies use credit scores to determine rates.

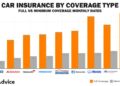

Types of Coverage Offered

- Basic Liability: Required by law and covers the other party's expenses in an accident you cause.

- Full Coverage: Combines liability, collision, and comprehensive coverage for maximum protection.

- Additional Options: You can add extras like roadside assistance, rental car coverage, or gap insurance.

Gathering Auto Insurance Quotes

When it comes to finding the best auto insurance policy for your needs, gathering multiple quotes is a crucial step in the process. By obtaining quotes from different providers, you can compare coverage options, premiums, and discounts to make an informed decision.

Tips for Obtaining Multiple Quotes Efficiently

- Utilize online comparison tools: Websites and platforms that allow you to input your information once and receive quotes from multiple insurance companies can save you time and effort.

- Reach out to local agents: Contacting local insurance agents can help you get personalized quotes and potentially uncover additional discounts that are not available online.

- Consider bundling policies: If you already have insurance coverage for your home or other vehicles, inquire about bundling discounts when requesting auto insurance quotes.

Importance of Comparing Quotes from Different Providers

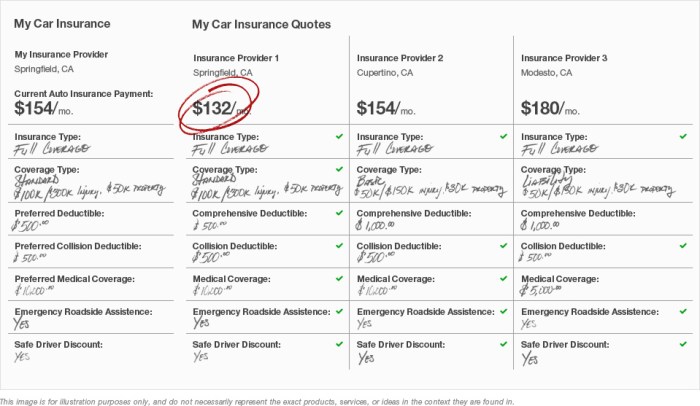

Comparing quotes from different insurance providers is essential to ensure you are getting the best coverage at a competitive rate. Each insurance company has its own underwriting criteria, pricing models, and discounts, so exploring multiple options can help you find the most cost-effective policy.

Strategies for Ensuring Accurate Information When Requesting Quotes

- Provide detailed and accurate information: When requesting quotes, make sure to provide precise details about your driving history, vehicle, and coverage needs to receive the most accurate quotes.

- Review and verify information: Double-check the information you input when requesting quotes to avoid any errors that could impact the accuracy of the quotes you receive.

- Ask questions and clarify doubts: If you are unsure about any aspect of the coverage or pricing provided in a quote, don't hesitate to reach out to the insurance company for clarification.

Evaluating Auto Insurance Quotes

When comparing auto insurance quotes, it is crucial to look beyond just the premium amounts. Evaluating coverage limits, deductibles, discounts, and additional benefits can help you make an informed decision on which policy is the best fit for your needs.

Analyzing Coverage Limits and Deductibles

One key factor to consider when evaluating auto insurance quotes is the coverage limits and deductibles offered by different insurance companies. Coverage limits determine the maximum amount your insurer will pay for a covered claim, while deductibles are the amount you must pay out of pocket before your insurance kicks in.

- Review the coverage limits for liability, collision, comprehensive, and other types of coverage to ensure they meet your needs.

- Consider how different deductibles can impact your premiums and out-of-pocket expenses in the event of a claim.

- Find a balance between coverage limits and deductibles that provides adequate protection without breaking the bank.

Comparing Premiums

Another important aspect to evaluate when comparing auto insurance quotes is the premiums offered by different insurance companies. Premiums are the amount you pay for your insurance policy and can vary based on factors such as your driving record, age, and the type of coverage you select.

- Obtain quotes from multiple insurers to compare premium amounts for similar coverage options.

- Consider the overall value of the policy, including the coverage limits and deductibles, when evaluating premium costs.

- Look for any hidden fees or charges that may impact the total cost of the policy.

Considering Discounts and Additional Benefits

When evaluating auto insurance quotes, it is essential to consider any discounts or additional benefits that may be included in the policies. Discounts can help lower your premium costs, while additional benefits can provide extra protection and peace of mind.

- Ask each insurer about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for safety features on your vehicle.

- Look for additional benefits like roadside assistance, rental car coverage, or accident forgiveness that may be included in some policies.

- Calculate the overall value of the policy by considering both the premium cost and any discounts or benefits offered.

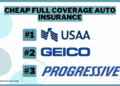

Choosing the Best Auto Insurance Quote

When it comes to choosing the best auto insurance quote, it's essential to consider various factors to ensure you're getting the coverage you need at a competitive rate. Here are some key points to keep in mind when comparing and selecting the most suitable quote.

Checklist for Comparing and Selecting

- Review Coverage Options: Compare the coverage options offered by different insurance providers to ensure they meet your needs.

- Consider Premium Costs: Look at the premium costs associated with each quote and determine if they fit within your budget.

- Check Deductibles: Compare the deductibles for each quote and decide on a level that you're comfortable with in case of a claim.

- Assess Customer Service: Research the reputation of insurance providers for their customer service and claims handling efficiency.

Key Details to Look For

- Financial Stability: Ensure the insurance provider is financially stable and capable of paying out claims when needed.

- Customer Reviews: Look for customer reviews and ratings to get an idea of the overall satisfaction level with the insurance company.

- Claims Process: Understand the claims process of each insurance provider to gauge how smoothly they handle claims.

- Discounts and Special Offers: Check for any discounts or special offers that could help lower your premium.

Negotiating for Better Rates

- Bundle Policies: Inquire about bundling your auto insurance with other policies like home or renters insurance for potential discounts.

- Ask for Discounts: Don't be afraid to ask for discounts based on the quotes you've gathered or your eligibility for certain discounts.

- Review Coverage Limits: Consider adjusting your coverage limits to find a balance between adequate coverage and affordable rates.

Final Thoughts

As we wrap up our discussion on how to compare auto insurance quotes the smart way, it's evident that being well-informed and strategic in this process can lead to significant benefits. By following the guidelines laid out in this guide, you're equipped to navigate the complex world of insurance quotes with confidence and precision, ensuring that you secure the most suitable coverage for your needs.

FAQ Explained

How can I ensure that I am getting accurate information when requesting insurance quotes?

It's essential to provide consistent and up-to-date details about your driving history, vehicle, and coverage needs to insurance providers to receive accurate quotes.

What factors should I consider when comparing premiums offered by different insurance companies?

Aside from the cost, it's crucial to evaluate the coverage limits, deductibles, discounts, and additional benefits included in the premiums to make an informed decision.

Is it possible to negotiate for better rates based on the gathered insurance quotes?

Yes, armed with multiple quotes, you can leverage this information to negotiate with insurance providers for better rates or additional benefits to tailor the quote to your needs.