Exploring the world of Over 50 Life Insurance Plans Designed for Stability, this introduction sets the stage for a detailed discussion on the importance of financial security and peace of mind for individuals in this age group. From understanding the concept of these specialized insurance plans to delving into the various factors that play a crucial role in decision-making, this overview aims to provide valuable insights for those seeking stability in their insurance coverage.

As we navigate through the different types of life insurance plans available, consider the key features that distinguish them and the benefits they offer. Let's uncover how stability in these plans can bring a sense of assurance and protection to older individuals, ensuring a secure future ahead.

Introduction to Over 50 Life Insurance Plans Designed for Stability

Over 50 life insurance plans are specifically tailored to meet the needs of individuals who are over the age of 50. These insurance plans offer coverage for individuals in this age group, providing financial protection and peace of mind for themselves and their loved ones.

Stability in life insurance is crucial for individuals over 50 as it ensures that their financial security remains intact during their later years. With stable life insurance plans, older individuals can rest assured that their beneficiaries will receive the necessary financial support in the event of their passing, without any uncertainties or fluctuations in coverage.

The Importance of Stability in Life Insurance for Individuals Over 50

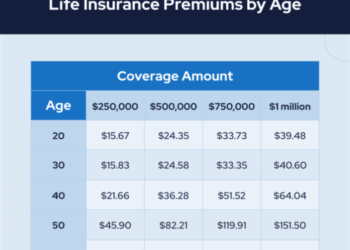

- Stable premiums: Over 50 life insurance plans with stable premiums ensure that individuals can budget effectively without worrying about sudden increases in costs.

- Guaranteed coverage: Stability in life insurance guarantees that coverage will remain in place, providing peace of mind for policyholders and their families.

- Financial security: Stable life insurance plans offer a sense of financial security for older individuals, knowing that their loved ones will be taken care of in the future.

Types of Over 50 Life Insurance Plans

When it comes to life insurance plans for individuals over 50, there are typically two main types to consider: term life insurance and whole life insurance. Each type offers unique features and benefits tailored to the needs of this demographic.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. This type of insurance is ideal for individuals who want coverage for a specific time frame, such as until their mortgage is paid off or their children are financially independent.

Key features of term life insurance include:

- Lower premiums compared to whole life insurance

- Coverage for a specific term

- No cash value accumulation

- Renewable and convertible options

Whole Life Insurance

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured individual. This type of insurance not only offers a death benefit but also includes a cash value component that grows over time. Key features of whole life insurance include:

- Lifetime coverage

- Cash value accumulation

- Fixed premiums

- Guaranteed death benefit

Factors to Consider When Choosing Over 50 Life Insurance Plans

When individuals over 50 are selecting a life insurance plan, there are several crucial factors to consider that can greatly impact their decision-making process. These factors include health conditions, financial stability, and the overall coverage provided by the insurance plan.

Health Conditions

Health conditions play a significant role in determining the type of life insurance plan that is suitable for individuals over 50. Pre-existing medical conditions can affect the premiums and coverage options available. It is essential to disclose all health information accurately to ensure the chosen plan adequately meets the individual's needs.

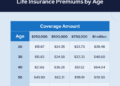

Financial Stability

Financial stability is another important factor to consider when choosing an over 50 life insurance plan. Premiums for life insurance can vary based on the individual's financial situation and income level. It is crucial to select a plan that is affordable and sustainable in the long run to ensure continued coverage without financial strain.

Overall Coverage

In addition to health conditions and financial stability, individuals over 50 should carefully review the overall coverage provided by the life insurance plan. This includes assessing the death benefit amount, policy term, and any additional riders or benefits that may be included.

It is essential to choose a plan that offers comprehensive coverage tailored to the individual's specific needs and goals.

Benefits of Stability in Over 50 Life Insurance Plans

Life insurance plans designed for stability offer numerous advantages for individuals in the over 50 age group. These plans provide a sense of security, peace of mind, and financial stability during challenging times. Let's explore how stability in life insurance plans can greatly benefit individuals in this age group.

Peace of Mind and Financial Security

Having a stable life insurance plan can bring peace of mind to individuals over 50, knowing that their loved ones will be financially protected in case of any unforeseen circumstances. This sense of security allows them to focus on enjoying life without worrying about the financial burden that may arise.

Support in Challenging Situations

Stable life insurance plans have been instrumental in providing support to individuals over 50 during challenging situations such as critical illness, accidents, or unexpected loss of income. These plans ensure that the policyholder and their beneficiaries are taken care of financially, offering a safety net when it is needed the most.

Examples of Stability in Action

There are numerous real-life examples where stable life insurance plans have made a significant difference in the lives of individuals over 50. From covering medical expenses to providing financial support to families after the policyholder's passing, these plans have proven to be a reliable source of stability and security.

Closing Summary

In conclusion, Over 50 Life Insurance Plans Designed for Stability not only offer financial security but also provide a sense of stability and peace of mind for older individuals. By understanding the importance of a stable insurance plan, individuals can safeguard their future and protect their loved ones, no matter what life may bring.

FAQ Insights

What are the key differences between term life insurance and whole life insurance for individuals over 50?

Term life insurance provides coverage for a specific term, while whole life insurance offers lifelong coverage with an investment component.

How do health conditions impact the choice of life insurance plans for individuals over 50?

Health conditions can affect premiums and eligibility for certain types of life insurance, influencing the choice of coverage for older individuals.

What advantages do stable life insurance plans offer for individuals over 50?

Stable life insurance plans provide a sense of security, peace of mind, and financial protection, especially during challenging situations.